Introduction

Investing in a plot in Bangalore is a significant decision, and understanding the associated costs is crucial. Among these, stamp duty and registration charges are mandatory expenses that can substantially impact your overall investment. This guide provides an in-depth look at the current rates, calculation methods, and legal considerations for plot purchases in Bangalore as of 2025

Understanding Stamp Duty and Registration Charges

What is Stamp Duty?

Stamp duty is a tax levied by the government on property transactions. It serves as legal evidence of the transaction and is essential for the registration of the property in the buyer’s name.

What are Registration Charges?

Registration charges are fees paid to the government for recording the property transaction in official records. This process ensures the legal transfer of ownership from the seller to the buyer.

Current Rates in Bangalore (2025)

As of 2025, the stamp duty and registration charges in Bangalore are as follows:

Stamp Duty Rates

-

For properties valued up to ₹20 lakh: 2%

-

For properties valued between ₹21 lakh and ₹45 lakh: 3%

-

For properties valued above ₹45 lakh: 5%

Note: These rates are applicable to both male and female buyers, as there are no gender-based concessions in Karnataka.

Registration Charges

-

All property values: 1% of the property’s market value

Additional Charges

Cess and Surcharge

In addition to stamp duty, buyers are required to pay:

-

Cess: 10% of the stamp duty

-

Surcharge:

-

Urban areas: 2% of the stamp duty

-

Rural areas: 3% of the stamp duty

-

These additional charges are applicable for properties priced above ₹35 lakh.

Calculating Stamp Duty and Registration Charges

The stamp duty is calculated based on the higher of the property’s market value or the guidance value set by the government.

Formula:

-

Stamp Duty = (Property Value) × (Applicable Stamp Duty Rate)

-

Registration Charge = (Property Value) × 1%

Example:

For a plot valued at ₹50 lakh in an urban area:

-

Stamp Duty: ₹50,00,000 × 5% = ₹2,50,000

-

Cess: ₹2,50,000 × 10% = ₹25,000

-

Surcharge: ₹2,50,000 × 2% = ₹5,000

-

Registration Charge: ₹50,00,000 × 1% = ₹50,000

-

Total Charges: ₹2,50,000 + ₹25,000 + ₹5,000 + ₹50,000 = ₹3,30,000

Legal Considerations

Importance of Paying Stamp Duty and Registration Charges

Paying the appropriate stamp duty and registration charges is essential for:

-

Legal Ownership: Ensures the buyer’s legal ownership of the plot.

-

Avoiding Penalties: Non-payment or underpayment can lead to penalties and legal disputes.

-

Loan Approvals: Financial institutions require proof of payment for loan approvals.

Penalties for Non-Compliance

Failure to pay the correct stamp duty and registration charges can result in

-

Penalties: Up to 200% of the deficient amount.

-

Legal Issues: The property transaction may be considered invalid, leading to potential legal complications.

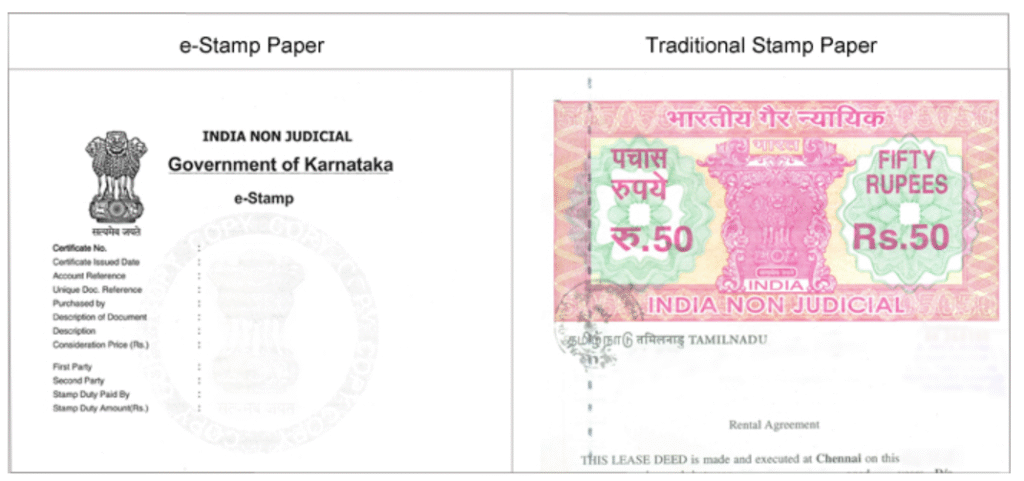

Payment Process

Online Payment

The Karnataka government provides an online portal, Kaveri Online Services, for the payment of stamp duty and registration charges. Buyers can calculate the charges and make payments through this portal.

Offline Payment

Alternatively, payments can be made at the sub-registrar’s office through demand drafts or cash.

Tax Benefits

Under Section 80C of the Income Tax Act, buyers can claim deductions of up to ₹1.5 lakh on the amount paid towards stamp duty and registration charges. However, this benefit is applicable only for new residential properties and not for plots.

Conclusion

Understanding the stamp duty and registration charges is crucial for anyone planning to purchase a plot in Bangalore. These charges can significantly impact the overall cost of the property. By being informed about the current rates and legal requirements, buyers can ensure a smooth and legally compliant transaction.

Need Assistance?

For personalized guidance and assistance in verifying land documents in Bangalore, feel free to contact us at 9123466308. Our team at Plotsure is dedicated to ensuring your land purchase is legally sound and hassle-free.