Introduction

Buying a plot of land is a major step toward building your dream home or making a smart investment. However, financing this purchase can seem overwhelming. Thankfully, several banks in Karnataka offer tailored land loan options to help individuals own a plot without financial strain. One such option is the Ghar Niveshan Loan by Karnataka Bank.

1. Understanding Plot Loans

Plot loans are financial products that help buyers purchase a piece of land for residential construction. These are different from home loans, which are specifically for constructing or buying an existing home. Key features of plot loans include eligibility criteria, tenure, interest rates, and repayment terms.

2. Karnataka Bank’s Ghar Niveshan Loan: A Viable Option

Karnataka Bank offers the Ghar Niveshan Loan, designed to help salaried individuals, professionals, and businesspeople purchase a residential plot. Here are its highlights:

- Eligibility: Available to resident individuals, salaried employees, professionals, and self-employed persons.

- Loan Amount: Finance of up to 75% of the plot’s value.

- Tenure: Maximum repayment tenure of 10 years.

- Security: Equitable mortgage of the plot to be purchased.

- Processing Fee: Competitive processing charges apply.

3. Benefits of the Ghar Niveshan Loan

- Quick loan processing and approval

- Transparent terms and minimal documentation

- Ideal for those planning future home construction

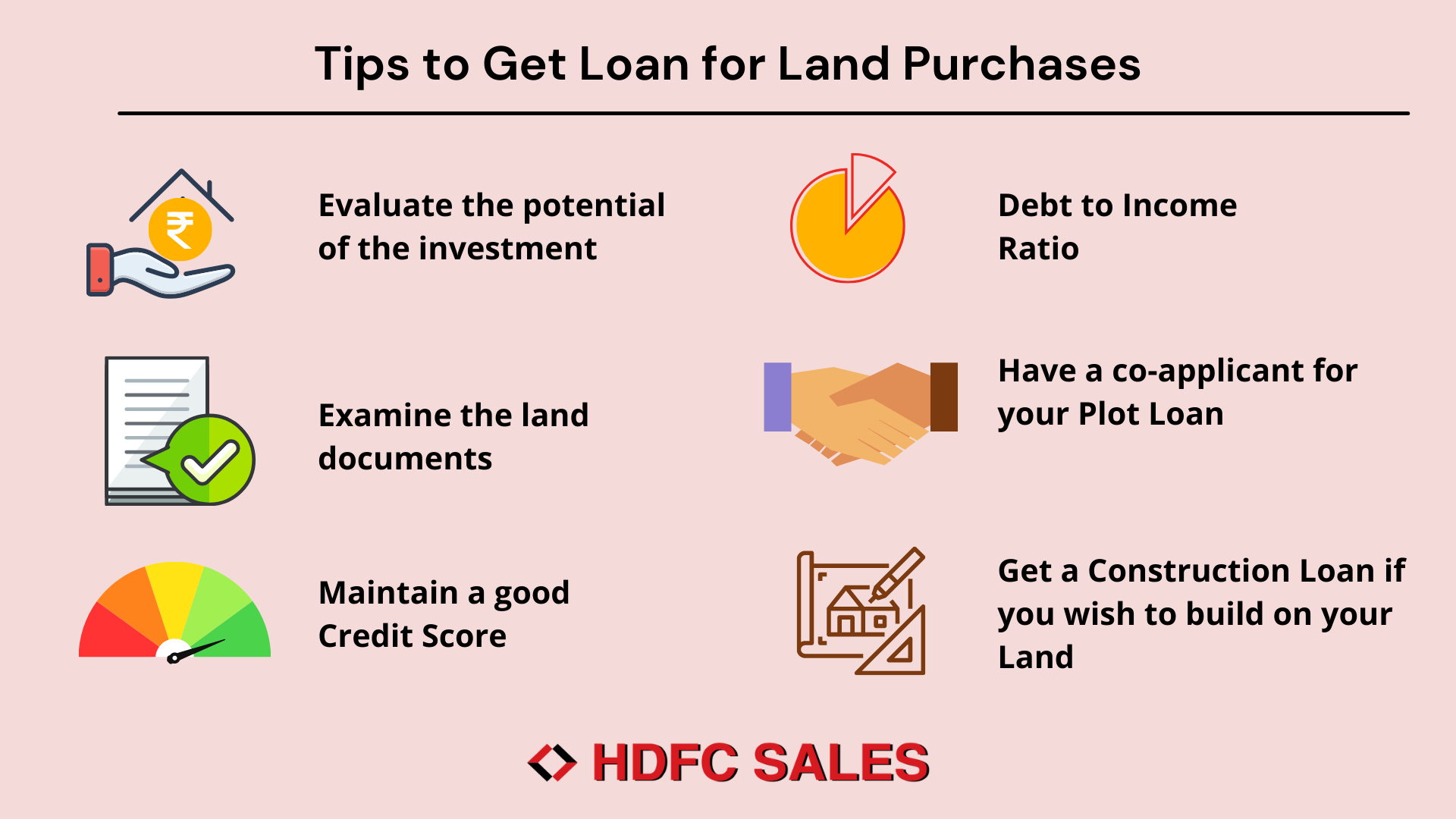

4. Additional Tips for Financing a Plot Purchase in Karnataka

- Research the Location: Ensure the plot is within municipal limits and has clear legal titles.

- Budget Wisely: Include registration, stamp duty, and legal charges in your budget.

- Check Credit Score: A good score improves your chances of approval.

- Compare Loan Offers: Consider different banks and their terms before finalizing.

5. How to Apply

- Visit the Karnataka Bank website or nearest branch.

- Fill out the loan application form.

- Submit required documents (ID proof, income proof, property documents).

- Await processing and approval.

Suggested Data & Graphs

1. Interest Rate Comparison Chart

-

Type: Bar chart or line graph

-

Title: Interest Rates for Land Loans (as of 2025)

-

Data Example:

| Bank | Interest Rate (%) |

|---|---|

| Karnataka Bank | 9.40% (approx.) |

| SBI | 8.85% |

| HDFC Bank | 9.00% |

| ICICI Bank | 9.10% |

| Axis Bank | 9.20% |

2. Loan EMI Calculation Table

-

Type: Table with optional pie chart

-

Title: EMI Breakdown for ₹10 Lakh Land Loan at 9.4% for 10 Years

| Component | Amount (₹) | Percentage |

|---|---|---|

| Principal Repaid | ₹10,00,000 | 67% |

| Interest Paid | ₹4,97,000 | 33% |

| Total Payable | ₹14,97,000 | 100% |

A pie chart can show the share of interest vs. principal visually.

3. Eligibility Criteria Flow Chart

-

Type: Flow chart

-

Purpose: To guide users on whether they qualify

-

Branches: Age >21 → Income Stable? → Credit Score >700? → Property Location?

4. Down Payment Distribution Pie Chart

-

Type: Pie chart

-

Title: Cost Distribution for Plot Purchase

-

Example:

| Cost Component | Percentage |

|---|---|

| Loan Amount | 75% |

| Down Payment | 25% |

Conclusion

Financing a plot purchase in Karnataka is easier with specialized loans like the Ghar Niveshan Loan from Karnataka Bank. With the right planning and information, you can make a smart and secure investment in your future home.

6 Responses

Casinobetzar is where I like to try my luck sometimes. It has good games and the interface is simple and straightforward, like it a lot. Want to try? Visit casinobetzar.

RS777vip is treating me well. Love the VIP perks. The games are hot, servers were stable. If you’re looking for a reliable place this is it. Join the elite: rs777vip

jiliokcc https://www.jiliokccw.com

phtaya06 https://www.phtaya06y.com

phtaya11 https://www.phtaya11y.com

[9919]7slots Casino Online México: Tragamonedas y Bonos de Bienvenida Descubre 7slots Casino Online México. Disfruta de las mejores tragamonedas y bonos de bienvenida exclusivos. ¡Regístrate ahora, juega seguro y gana premios reales! visit: 7slots