Introduction

Investing in a plot in Bangalore is a significant decision, and understanding the legal nuances is crucial. One of the most vital aspects to consider is the type of Khata associated with the property. In Bangalore, properties are classified under two primary Khata categories: A Khata and B Khata. This classification impacts property legality, taxation, and eligibility for loans and approvals. In this article, we’ll delve into the differences between A Khata and B Khata, recent government updates, and what every plot buyer should know.

What is Khata?

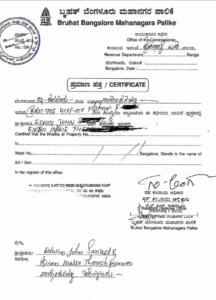

A Khata is an official document issued by the Bruhat Bengaluru Mahanagara Palike (BBMP) that certifies property ownership and is essential for paying property taxes. It includes details like the property’s size, location, and built-up area. Having a Khata is mandatory for property registration, obtaining building permits, and securing loans.

A Khata: The Gold Standard

An A Khata signifies that a property complies with all BBMP regulations, including building bylaws, zoning laws, and tax payments. Properties with an A Khata are considered legal and are eligible for:

-

Building plan approvals

-

Bank loans

-

Trade licenses

-

Property resale and transfer

-

Access to civic amenities

Obtaining an A Khata involves submitting necessary documents, paying property taxes, and ensuring the property adheres to all legal requirements.

B Khata: Understanding the Limitations

A B Khata is issued to properties that have deviations from approved plans or are in unauthorized layouts. While it allows property owners to pay taxes, it does not confer full legal status. Limitations of a B Khata include:

-

Ineligibility for building plan approvals

-

Difficulty in obtaining bank loans

-

Challenges in property resale or transfer

-

Limited access to civic amenities

It’s important to note that a B Khata is not a permanent solution, and property owners are encouraged to convert it to an A Khata.

Key Differences Between A Khata and B Khata

| Feature | A Khata | B Khata |

|---|---|---|

| Legal Status | Fully legal and compliant | Not fully legal; has deviations |

| Loan Eligibility | Eligible for bank loans | Difficult for obtaining bank loans |

| Building Approvals | Can obtain building plan approvals | Cannot obtain building plan approvals |

| Property Transfer | Easily transferable | Transfer may face legal hurdles |

| Access to Amenities | Full access to civic amenities | Limited access to civic amenities |

Recent Government Updates

In a move to regularize unauthorized properties, the Karnataka government has extended the deadline for issuing A and B Khatas by three months, as of May 2025. This extension aims to bring more properties under the legal framework and increase property tax revenue. Property owners are encouraged to utilize this window to regularize their properties.

Converting B Khata to A Khata

Converting a B Khata to an A Khata involves:

-

Ensuring the property is in a layout approved by the BDA or BBMP.

-

Paying all pending property taxes.

-

Paying betterment charges as specified by the BBMP.

-

Submitting necessary documents, including the sale deed, tax receipts, and approved layout plan.

This conversion is crucial for property owners to gain full legal status and access to various benefits.

Conclusion

Understanding the distinction between A Khata and B Khata is essential for any plot buyer in Bangalore. While A Khata properties offer full legal compliance and associated benefits, B Khata properties come with limitations and potential legal challenges. Staying informed about government regulations and taking proactive steps to ensure your property’s legal status can safeguard your investment and provide peace of mind.

Need Assistance?

For more information or assistance in verifying the Khata status of a property, feel free to contact us at 9123466308. Our team is here to guide you through the process and ensure your property transactions are smooth and legally compliant.